'Resident of nowhere': Quebec student denied loans by two provinces

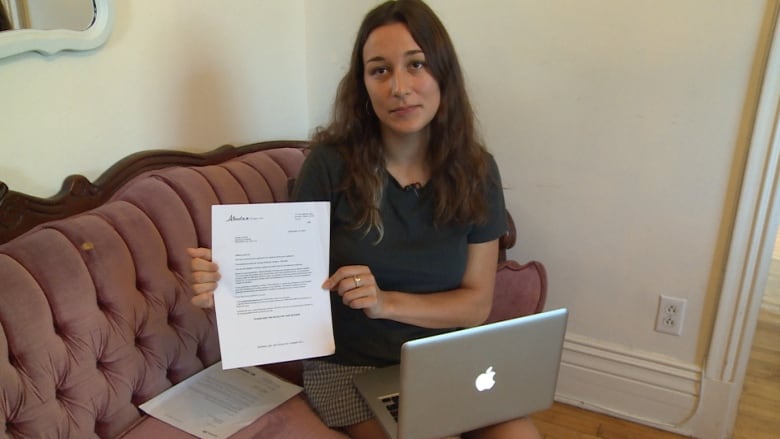

Emma Austin says the province should have notified students about its change to loan eligibility

A change to Quebec's student loan rules is causing a stressful start to the semester for a Concordia University undergraduate.

Emma Austin has spent the last three years pursuing a degree in sociology part-time. This year, she enrolled as a full-time student, assuming a student loan would help ease her tuition-fee burden.

However, since she checked Quebec's student loan eligibility requirements last year, the rules have changed — and her loan request was rejected.

While Quebec had previously required those wishing to be eligible for a provincial student loan to live in the province for 12 months without studying full-time, the rules now state they must not be enrolled in any post-secondary program at all.

"I was completely caught off guard, because nowhere had I ever read before that I wasn't able to study part-time during these 12 months," said Austin, 26, who moved to Montreal from Alberta in 2015.

Penalty if tuition not paid by Sept. 30

She works a part-time job to cover her day-to-day expenses but says she does not have enough savings to cover the $1,500 in tuition fees she owes for her full-time course load this semester.

If she does not pay by Sept. 30, Concordia will charge a late fee, and an eight per cent annual interest rate, compounded monthly, will be applied to her outstanding tuition.

When she checked Quebec's student loan rules last year, the website noted that to be eligible you must not be a full-time student for 12 months — the same requirement for becoming eligible for Quebec's in-province tuition rate.

After receiving a call informing her that her claim was rejected, she checked the website again and saw the eligibility requirements had changed.

Emma Austin says her experience has left her feeling like a 'resident of nowhere,' and she's not sure how she will pay her tuition before the Sept. 30 deadline. (Matt D'Amours/CBC Montreal)

The government bureaucrat she spoke to "said that all day he had been giving people this bad news, catching people off guard that were also in my situation," said Austin.

She was told her best option was to contact Alberta Student Aid.

However, that claim was also rejected.

"As Quebec is the most recent province you have lived in for 12 consecutive months while not attending full-time study, you are considered a resident of Quebec," reads the letter sent from Alberta.

Meanwhile, her letter from Quebec says the reason for her rejection is that "you are not a Quebec resident."

Inconsistent residence requirements

When applying for her Quebec student loan, she provided a copy of her lease and her health insurance card, issued by the Régie de l'assurance maladie du Québec (RAMQ). She says she is also eligible to vote in the October provincial election.

Despite that, according to Quebec's Aide financière aux études, she is not a resident of the province.

While student loans are federally funded, they are administered by inpidual provinces and territories. A spokesperson for Employment and Social Development Canada told CBC News that the federal government provided $334 million in student loan funding to Quebec for the 2016-17 loan year.

CBC News asked a spokesperson from the Quebec Ministry of Education for the rationale behind the eligibility change and how many students were affected. The ministry responded with a list of current eligibility requirements.

"I think it's crazy that I can't access this federal funding just because I lived in two provinces," Austin said.

"I feel like a resident of nowhere."

Austin says for the time being, she's not considering moving back to Alberta. She has been working as a caregiver for children in the same family for three years.

She's also made friends here and plays in a band. Montreal is her home now, and she doesn't want to leave.

However, had she known she would not be eligible for a student loan, she said, she might have reconsidered coming to the province to study.

She said if the government does not decide to reverse its rules on student loan eligibility, she hopes that she can get an exemption, since she is already halfway through her undergraduate studies.

"Now you're trapping me, essentially, in a grey area," she said.

If that exemption does not come through, she says she will try to get a student line of credit to make her tuition payment in time.

CBC